Can Security Turn Competition into Cooperation?

For more than two decades, the freight industry has dreamed of a digital exchange that could perfectly match capacity with demand: a marketplace where every truck, trailer, and shipment could find its counterpart in real time. Many have tried. Few have endured.

Each platform promised efficiency, transparency, and lower costs. Yet most eventually faced the same quiet collapse – not from lack of technology, but from the logic of incentives.

The Dilemma Beneath the Dashboard

Economists would call it a Prisoner’s Dilemma.

Every shipper wants broad visibility but fears losing control. Every carrier wants access to freight but fears margin erosion. So both hedge. They maintain private relationships, keep partial visibility, and use digital platforms selectively.

Individually, each decision is rational. Collectively, the result is fragmentation – multiple systems, duplicated effort, and persistent fraud and theft.

That’s what game theorists call a stable but inefficient equilibrium. Everyone’s strategy makes sense given everyone else’s, but the system as a whole underperforms.

Why Defecting Makes Sense

Defection – choosing autonomy over cooperation – offers immediate benefits: flexibility in pricing, direct relationships, less dependency on third-party platforms.

And for years, it carried no penalty. You could step outside the system and still ship freight safely. Which meant that even as technology advanced, the payoff for cooperating never exceeded the freedom of going it alone.

Changing the Payoff Structure

But what if defection isn’t free anymore?

What if operating outside a verified network means exposure to cargo theft, double brokering, false identities, and stolen credentials? And what if cooperation automatically brings protection: trailers that lock out unauthorized access, telematics that verify custody, and rules that can be enforced by the equipment itself?

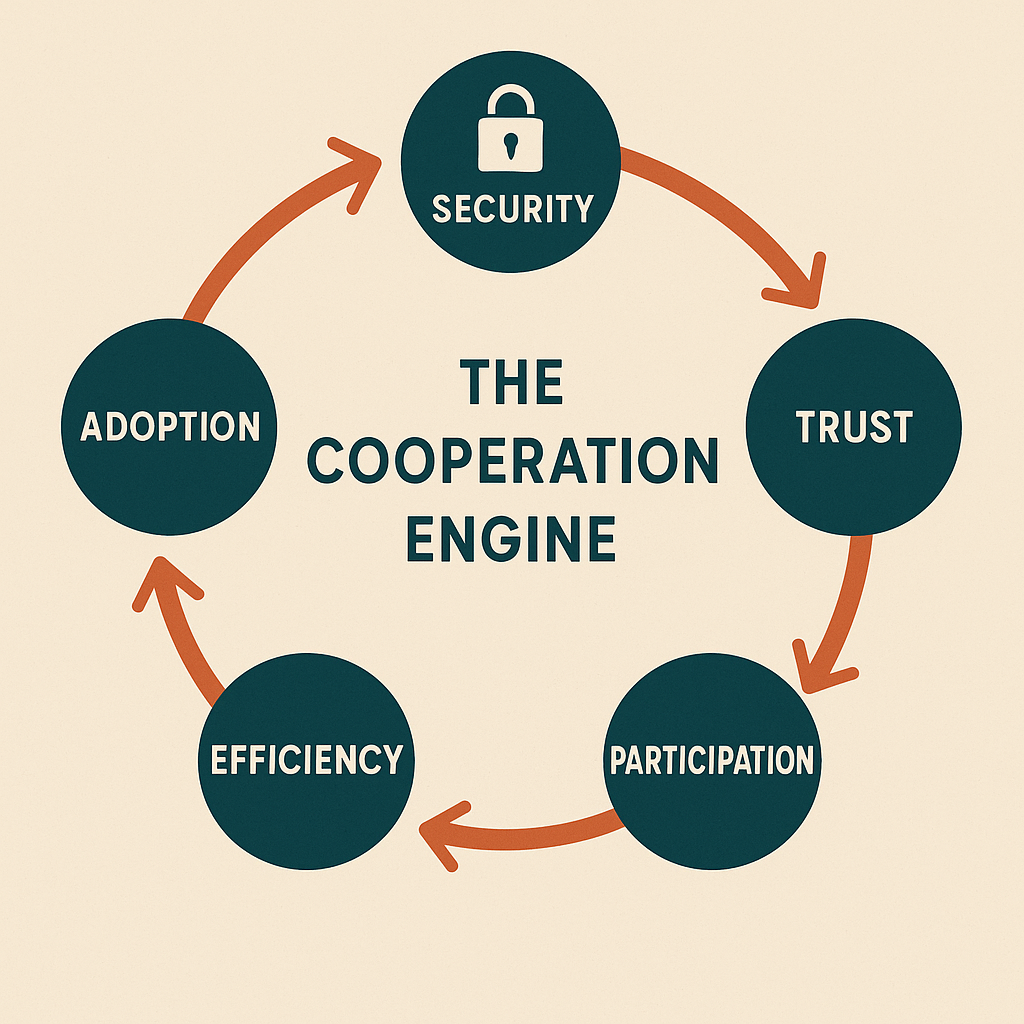

In that world, cooperation stops being idealistic. It becomes the rational choice. The equilibrium shifts:

- Defection = exposure.

- Cooperation = protection, verification, and efficiency.

The payoff structure has changed.

When staying inside a secure, verifiable network materially reduces theft and fraud, participation isn’t altruism. It is risk management. And participation compounds: as more shippers and carriers transact under enforced custody rules, discovery improves, dwell drops, and rework shrinks. Efficiency stops being a promise and becomes the baseline.

That raises a fair question: who loses when those efficiencies are gained?

Not the shipper or the carrier. The “losers” are waste and opacity: cargo theft, double brokering, phone-tag scheduling, and spreadsheet reconciliations. The surplus doesn’t vanish; it reallocates into fewer losses, faster turns, cleaner audits, and tighter cash cycles. That’s a win-win grounded in physics (locks and telemetry), not sentiment.

Carrier Autonomy

And what about autonomy? Does a secure venue erode it? Only if the venue takes a position.

In a stock-exchange model, the platform is neutral infrastructure: participants author their own prices and constraints, the venue standardizes contracts and identities, and the equipment enforces only the rules the parties chose. Competition remains intact – carriers still differentiate on service, shippers still choose on value – while the market becomes efficient through transparent discovery and standardized execution, not through a yield-optimizing “house algorithm.”

In other words: cooperation without concession. Autonomy is preserved, competition continues, and the gains come from removing loss and friction – not from shifting power to the platform.

From Trust to Enforcement

True cooperation doesn’t come from better integrations. It comes from credible enforcement. When trust moves from policy to mechanism, when decisions are resolved explicitly, when execution is coordinated across parties, and when equipment itself can enforce who is allowed to move or access freight, then trust stops being a leap of faith. It becomes infrastructure.

In practice, that means connecting resolution (who is authorized to decide), execution (how those decisions propagate across yards, docks, and carriers), and enforcement (where custody and access are physically constrained). These layers — Resolve, Execute, and Enforce — form a trust infrastructure that does not depend on goodwill, supervision, or perfect coordination.

At that point, competition doesn’t disappear; it becomes safer. Carriers still compete on service. Shippers still compete on price. But the baseline of trust (who is allowed to act) is enforced by design.

A New Equilibrium

The freight market doesn’t need another exchange. It needs a new equilibrium, one where cooperation pays more than defection because security, not trust in counterparties, guarantees fairness.

That’s what we’re building at Admiral: a trust infrastructure that allows equipment itself to enforce custody and compliance, turning a fragmented market into a self-governing one.

When cooperation is safer than autonomy, competition finally works.

Learn more

The question isn’t whether freight can be digitized, it already is. The question is whether digital systems can enforce trust the way paper and people once did.

If you believe the industry can’t scale on goodwill alone, it’s time to rethink how security rewrites the rules of cooperation.

Stay Connected

Want more insights like this? Follow Level5Fleet for future articles, freight industry trends, and updates on building a smarter, more secure supply chain:

🔗 LinkedIn

🐦 X: @Level5fleet

📘 Facebook

📸 Instagram

Trust Infrastructure for Freight